Amortization of premium on bonds payable

/What is the Amortization of Premium on Bonds Payable?

When a company issues bonds, investors may pay more than the face value of the bonds when the stated interest rate on the bonds exceeds the market interest rate. If so, the issuing company must amortize the amount of this excess payment over the term of the bonds, which reduces the amount that it charges to interest expense. The concept is best described with the following example.

Related AccountingTools Courses

Example of the Amortization of a Bond Premium

ABC International issues $10,000,000 of bonds at an interest rate of 8%, which is somewhat higher than the market rate at the time of issuance. Accordingly, investors are willing to pay more than the face value of the bonds, which drives down the effective interest rate that they receive. Thus, ABC receives not only $10,000,000 for the bonds, but also an additional $100,000, which is a premium over the face value of the bonds. ABC records the initial receipt of cash with this journal entry:

If ABC were to report the sale of bonds on its balance sheet immediately after the bond issuance, the bonds payable account and the premium on bonds payable account would be netted together, so that the total amount of the bond presented would be $10,100,000.

ABC must then reduce the $100,000 premium on its bonds payable during each accounting period that the bonds are outstanding, until the balance in the Premium on Bonds Payable account is zero when the company has to pay back the investors. The bonds have a term of five years, so that is the period over which ABC must amortize the premium.

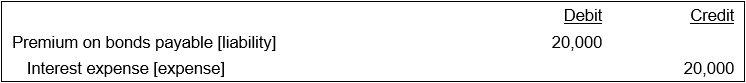

There are two ways for ABC to amortize the premium. Since the premium is so small, it can amortize the amount on a straight-line basis, and simply credit $20,000 to interest expense in each year, with the following entry:

The amount is a credit to interest expense, since it represents a reduction of the stated interest rate of 8% on the bonds; this is the case because investors paid more that the face value of the bonds, so the effective interest rate to the company is lower than 8%.

As the balance in the premium on bonds payable account declines over time, this means that the net amount of the bonds payable account and premium on bonds payable account presented in the balance sheet will gradually decrease, until it is $10,000,000 as of the date when the bonds are to be repaid to investors.

Effective Interest Method

The second way to amortize the premium is with the effective interest method. The effective interest method is a more accurate method of amortization, but also calls for a more complicated calculation, since it changes in each accounting period. This method is required for the amortization of larger premiums, since using the straight-line method would materially skew the company's results.

Journal Entry Format

The format of the journal entry for amortization of the bond premium is the same under either method of amortization - only the amounts change.