Systematic expensing definition

/What is Systematic Expensing?

Systematic expensing is the charging of an asset to expense over a period of time, using a consistently-applied methodology. This approach is commonly used for depreciation and amortization, where a straight-line, accelerated, or usage-based expensing approach is applied. Systematic expensing is needed in these cases, because there is no evidence of the sale or consumption of an asset that would otherwise trigger a charge to expense.

Example of Systematic Expensing

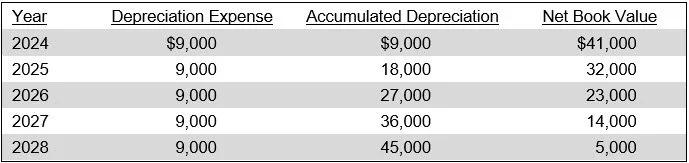

As an example of systematic expensing, Norrona Software has purchased high-performance office computers as of January 1, 2024 for $50,000. The useful life of these computers is five years, with a $5,000 salvage value. The company depreciates its assets using the straight-line method. Norrona’s accountant determines that the depreciable amount is $45,000, which is calculated as the $50,000 cost of the computers, minus their $5,000 salvage value. The annual depreciation expense will be $9,000, which is calculated as the $45,000 depreciable amount, divided by the five-year useful life of the assets. For each year of systematic expensing, the company records a $9,000 debit to its depreciation expense account and a $9,000 credit to its accumulated depreciation account. Over time, these entries result in the following declining balance in the book value of the computer asset:

At the end of year 5 (2028), the net book value of the asset equals its salvage value ($5,000), and no further depreciation is recorded.

Fraudulent Use of Systematic Expensing

Systematic expensing can be subject to abuse, if the expensing period is longer than the useful life of an asset. When this happens, the profits of the reporting entity will be somewhat overstated, because the associated depreciation is being spread over a longer period than when the underlying asset is actually being used to generate revenue.