How to account for cash dividends

/What is a Cash Dividend?

A cash dividend is the standard form of dividend payout authorized by a corporation’s board of directors. These dividends are typically authorized for payment in cash on either a quarterly or annual basis, though special dividends may also be issued from time to time.

Accounting for a Cash Dividend

When a cash dividend is declared by the board of directors, debit the retained earnings account and credit the dividends payable account, thereby reducing equity and increasing liabilities. Thus, there is an immediate decline in the equity section of the balance sheet as soon as the board of directors declares a dividend, even though no cash has yet been paid out.

When a dividend is later paid to shareholders, debit the Dividends Payable account and credit the Cash account, thereby reducing both cash and the offsetting liability. The net effect of these two transactions is to reduce cash and equity, which means that the entire impact of the cash dividend is contained within the balance sheet; there is no impact on the income statement, though the payment will appear as a use of cash in the financing activities section of the statement of cash flows.

Related AccountingTools Courses

Example of the Accounting for Cash Dividends

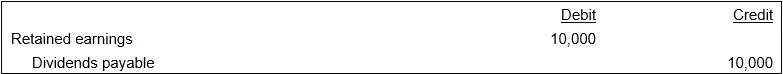

The board of directors of Hostetler Corporation declares a $1 dividend for each of the company's 10,000 shares outstanding. You would record the following entry:

One month later, the company pays the dividend, so record the following entry: