Statement of comprehensive income explained

/What is the Statement of Comprehensive Income?

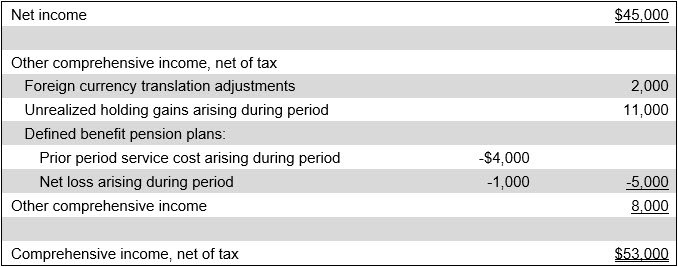

The statement of comprehensive income contains those revenue and expense items that have not yet been realized. It accompanies an organization’s income statement, and is intended to present a more complete picture of the financial results of a business. It is typically presented after the income statement within the financial statements package, and sometimes on the same page as the income statement. A sample report appears next.

A smaller business with relatively simple operations may not have engaged in any of the transactions that normally appear on a statement of comprehensive income. If so, they do not need to produce the statement.

Contents of the Statement of Comprehensive Income

The statement of comprehensive income begins with the net income figure drawn from the income statement, to which adjustments are made for unrealized items, such as unrealized gains and unrealized losses related to foreign currency translations and hedges. These various items are then totaled into a comprehensive income total at the bottom of the report. A positive balance in this report will increase shareholders’ equity, while a negative balance will reduce it; the change appears in the accumulated other comprehensive income account.

Related AccountingTools Courses

Advantages of the Statement of Comprehensive Income

There are several advantages associated with issuing a statement of comprehensive income, which are as follows:

Provides a complete view of financial performance. The report includes both realized and unrealized gains/losses, which gives a fuller picture of a company’s profitability. It shows how factors such as foreign currency adjustments, pension gains/losses, and unrealized investment gains affect the financial health of the firm.

Highlights non-operating gains and losses. The report identifies income that is not from core operations (e.g., unrealized investment gains, hedge adjustments). This helps investors separate operating performance from financial market effects.

Enhances transparency. The report gives investors a better understanding of true earnings beyond just net income. This helps them to assess the long-term financial stability of a business.

Useful for risk assessment. Some components of the report, such as foreign exchange fluctuations and pension liabilities, signal financial risks. This helps companies and investors prepare for potential future financial volatility.

Required for regulatory compliance. IFRS and U.S. GAAP require publicly traded companies to report comprehensive income.

Disadvantages of the Statement of Comprehensive Income

Though this statement has some predictive value, it makes no indication of the timing for when revenue and expense items will be realized in the future. Also, this statement introduces complexity to the financial reporting package that can be annoying for the accounting department producing it, and provides information that some users have complained is excessively esoteric to be overly useful.

FAQs

How Does Comprehensive Income Differ from Net Income?

Comprehensive income differs from net income because it includes both net income and other comprehensive income. Net income captures operating results, while other comprehensive income captures unrealized gains and losses that bypass the income statement. Together, they show the total change in equity from nonowner sources.