Closing entries definition

/What are Closing Entries?

Closing entries are those journal entries made in a manual accounting system at the end of an accounting period to shift the balances in temporary accounts to permanent accounts. This is a necessary part of the closing process that occurs at the end of each reporting period.

Temporary Accounts and Permanent Accounts

Temporary accounts are used to compile transactions that impact the profit or loss of a business during a year, while permanent accounts maintain an ongoing balance over time. Examples of temporary accounts are the revenue, expense, and dividends paid accounts. Any account listed in the balance sheet (except for dividends paid) is a permanent account. A temporary account accumulates balances for a single accounting period, whereas a permanent account stores balances over multiple periods.

The Flow of Closing Entries

As an example of the flow of closing entries, one such entry is to transfer all revenue and expense account totals at the end of an accounting period to an income summary account, which effectively results in the net income or loss for the period being the account balance in the income summary account; then, you shift the balance in the income summary account to the retained earnings account. As a result, the temporary account balances are reset to zero, so that they can be used again to store period-specific amounts in the following accounting period, while the net income or loss for the period is accumulated in the retained earnings account.

As an another example, you should shift any balance in the dividends paid account to the retained earnings account, which reduces the balance in the retained earnings account. This resets the balance in the dividends paid account to zero.

It is also possible to bypass the income summary account and simply shift the balances in all temporary accounts directly into the retained earnings account at the end of the accounting period.

Related AccountingTools Courses

Examples of Closing Entries

The following journal entries show how closing entries are used:

1. Shift all $10,000 of revenues generated during the month to the income summary account:

| Debit | Credit | |

| Revenue | 10,000 | |

| Income summary | 10,000 |

2. Shift all $9,000 of expenses generated during the month to the income summary account (there is assumed to be just one expense account):

| Debit | Credit | |

| Income summary | 9,000 | |

| Expenses | 9,000 |

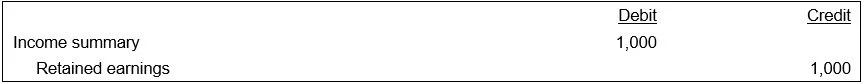

3. Shift the $1,000 net profit balance in the income summary account to the retained earnings account:

Once you have completed and posted all closing entries, the final step is to print a post-closing trial balance, and review it to ensure that all entries were made correctly.

The Automation of Closing Entries

All modern accounting software automatically generates closing entries, so these entries are no longer required of the accountant; it is usually not even apparent that these entries are being made.

Related Articles

Accounts That are Closed at Year End

The Difference Between Adjusting Entries and Closing Entries

The Difference Between Adjusting Entries and Correcting Entries