Income summary account

/What is the Income Summary Account?

The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period. The income summary account is an intermediate point at which revenue and expense totals are accumulated before the resulting profit or loss passes through to the retained earnings account. As such, the account is not strictly necessary. However, it can provide a useful audit trail, showing how these aggregate amounts were passed through to retained earnings.

If you are using accounting software, the transfer of account balances to the income summary account is handled automatically whenever you elect to close the accounting period. It is entirely possible that there will not even be a visible income summary account in the computer records. It is also possible that no income summary account will appear in the chart of accounts.

How Does the Income Summary Account Work?

The net amount transferred into the income summary account equals the net profit or net loss that the business incurred during the period. Thus, shifting revenue out of the income statement means debiting the revenue account for the total amount of revenue recorded in the period, and crediting the income summary account.

Likewise, shifting expenses out of the income statement requires you to credit all of the expense accounts for the total amount of expenses recorded in the period, and debit the income summary account. This is the first step to take in using the income summary account.

If the resulting balance in the income summary account is a profit (which is a credit balance), then debit the income summary account for the amount of the profit and credit the retained earnings account to shift the profit into retained earnings (which is a balance sheet account). Conversely, if the resulting balance in the income summary account is a loss (which is a debit balance), then credit the income summary account for the amount of the loss and debit the retained earnings account to shift the loss into retained earnings. This is the second step to take in using the income summary account, after which the account should have a zero balance.

Related AccountingTools Courses

Example of the Income Summary Account

The following journal entries show how to use the income summary account:

1. Shift all $10,000 of revenues generated during the month to the income summary account:

| Debit | Credit | |

| Revenue | 10,000 | |

| Income summary | 10,000 |

2. Shift all $9,000 of expenses generated during the month to the income summary account (there is assumed to be just one expense account):

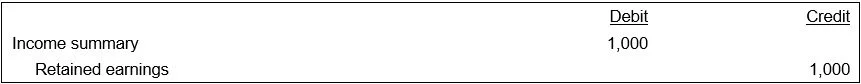

3. Shift the $1,000 net profit balance in the income summary account to the retained earnings account: